- Home

- Departments

- Finance

- Revenue

- Property Tax

Property Tax

Tax Rate

Property Tax Rate: $0.714778 per $100 of valuation

Note: All taxes are per $100 of taxable value. For property tax rates in other jurisdictions, refer to the Tarrant County Appraisal District.

City of White Settlement Property Tax Rate By Tax Year

- 2025 Tax Calculation Worksheets

- 2024 Tax Calculation Worksheets

- 2023 Tax Calculation Worksheets

- 2022 Tax Calculation Worksheets

- 2021 Tax Calculation Worksheets

- 2020 Tax Calculation Worksheets

- 2019 Tax Calculation Worksheets

- 2018 Tax Calculation Worksheets

- 2017 Tax Calculation Worksheets

- 2016 Tax Calculation Worksheets

- 2015 Tax Calculation Worksheets

- 2014 Tax Calculation Worksheets

- 2025 Notice of Public Hearing

- 2024 Notice of Public Hearing

- 2023 Notice of Public Hearing

- 2022 Notice of Public Hearing

- 2021 Notice of Public Hearing

- 2020 Notice of Public Hearing

- 2025 Notice of Adopted Tax Rate

- 2024 Notice of Adopted Tax Rate

- 2023 Notice of Adopted Tax Rate

- 2022 Notice of Adopted Tax Rate

- 2021 Notice of Adopted Tax Rate

- 2020 Notice of Adopted Tax Rate

- 2025 Notice of No New Revenue Rate

- 2024 Notice of No New Revenue Rate

- 2022 Notice of No New Revenue Rate

- 2021 Notice of No New Revenue Rate

- 2020 Notice of No New Revenue Rate

- 2019 Notice of Tax Rate

- 2018 Notice of Tax Rate

- 2017 Notice of Tax Rate

- 2016 Notice of Tax Rate

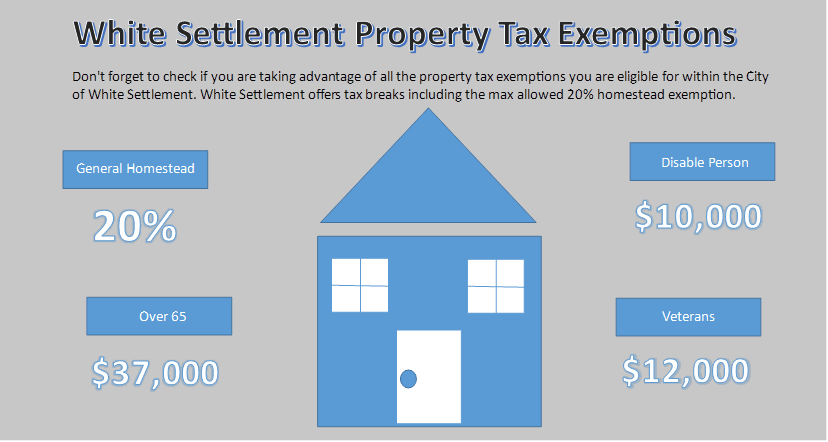

Exemptions

NOTICE OF ESTIMATED TAXES AND TAX RATE ADOPTION INFORMATION

Visit Texas.gov/propertytaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes.

You may also access the Truth in Taxation site for Tarrant County directly using the following link: https://tarranttaxinfo.com

Instructions for subscribing for TNT updates as taxing units update information:

- Navigate to https://tarranttaxinfo.com in your web browser

- Search for a property

- Click view

- Click “Subscribe to Notifications” button located in the top right hand corner or the page. Enter your information, agree to receive email notifications, click confirm

Property owners have the right to request the information from the assessor of each taxing unit for their property

Appraisal

Properties located within the City are appraised by the Tarrant Appraisal District (TAD). Some important dates and deadlines to remember during the tax year are:

- April 30: Last day to file an exemption application at Tarrant Appraisal District.

- May 31: Last day to file a protest with TAD for the current year.

- July 25: The Chief Appraiser certifies the appraisal roll to the taxing units

- July 31: This is the last day to make final payment on a payment plan.

- September 30: All tax rates must be set by taxing units.

To appeal the appraisal of a property, search property appraisal values, make an application for an exemption/deferral, or inquire about other appraisal-related items, please contact:

Tarrant Appraisal District

2500 Handley-Ederville Road

Fort Worth, TX 76118

817-284-0024

Collection

In October, annual property tax statements are mailed out by the Tarrant County Tax Assessor-Collector. The Tarrant County Tax Office handles property tax billings and collections on behalf of the City. Some important dates and deadlines to keep in mind are:

- October 1: The current collection period begins. Tax statements are mailed on or as soon as possible thereafter this date, throughout the county to real and personal property owners.

- February 1: Penalty and interest charges begin to accrue on taxes for the preceding year. Penalty begins at 6% and increases monthly to a maximum of 12% in July. Interest begins to accrue at the rate of 1% per month until the account is paid in full.

- July 1: All delinquent accounts for the current year are turned over to the tax attorneys for collection. A collection penalty of 15% of the total unpaid balance is added to the current delinquent accounts.

You may pay your taxes, search property tax accounts, estimate taxes, and renew automobile registration by contacting:

Tarrant County Tax Office (Tax Assessor-Collector)

100 East Weatherford Street

Fort Worth, TX 76196

taxoffice@tarrantcounty.com

817- 884-1100